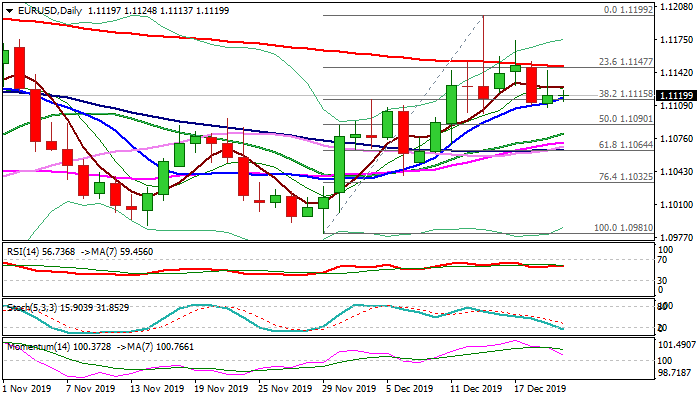

Recent strong upside rejections weigh heavily and keep bias with bears

The Euro is holding within narrow range in early Friday’s trading but remains biased lower as long upper shadow on Thursday’s candle signals recovery rejection (capped under 200DMA).

Last week’s multiple rejections at 200DMA and 13 Dec daily candle with very long upper shadow, continue to weigh and added to yesterday’s recovery stall.

Fading daily bullish momentum warn of further losses, but fresh weakness might be delayed on oversold stochastic.

Bears need weekly close below cracked Fibo support at 1.1115 (38.2% of 1.0981/1.1199) to generate signal for extension of pullback from 1.1199 spike high and expose strong supports at 1.1070 zone (daily cloud top / Fibo 61.8% / converged 10/30/100DMA’s).

Extended sideways mode could be expected while 1.1115 Fibo support holds, but the downside is expected to remain vulnerable as long as 200DMA limits upticks and only firm break here would provide relief.

A batch of US data scheduled later today would provide fresh direction signals.

Res: 1.1126; 1.1148; 1.1174; 1.1199

Sup: 1.1107; 1.1090; 1.1072; 1.1064