Recovery is seen as positioning as bears dominate; central banks eyed for stronger signals

Cable moved higher in early European trading on Monday, following tight range in Asia.

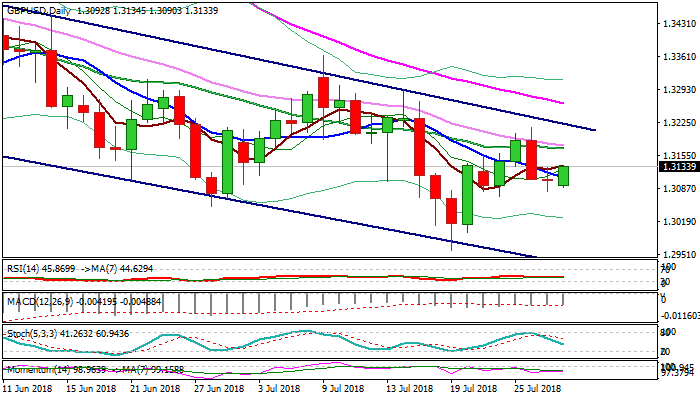

Friday’s action ended in Doji candle after failing to break Fibo 50% support at 1.3085, with subsequent bounce seen as positioning, as primary trend is negative and daily techs are in bearish setup.

Falling and widening hourly cloud (1.3128/51) marks solid resistance, which should ideally limit upticks and guard upper trigger at 1.3176 (converged 20/30SMA’s).

Only break above 1.3219 (upper boundary of bear-channel) would sideline bears.

Central banks are in focus this week, with Fed coming on Wednesday and expected to signal the third rate hike this year in September’s FOMC meeting, while the BoE’s MPC is meeting on Thursday, with wide expectations for quarter point rate hike.

Res: 1.3151; 1.3176; 1.3219; 1.3263

Sup: 1.3085; 1.3071; 1.3055; 1.3000