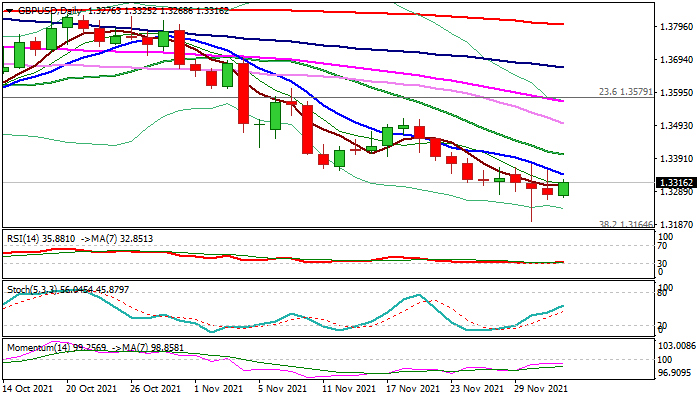

Recovery likely to be limited but formation of weekly hammer warns

Cable gained traction in early Thursday and edges above 1.33 mark, after spike to new 2021 low (1.3194) was short-lived.

Larger bears faced strong headwinds at 1.3275/50 zone Fibo 61.8% of 1.2675/1.4249 upleg / weekly cloud base), with hammer forming on a weekly chart that could be an initial positive signal.

On the other side, overall picture on daily chart is bearish, although north-heading RSI and stochastic suggest there might be some room for bounce.

Recovery faces initial requirements on break above falling 10/20DMA’s 1.3340/1.3401) to ease bearish pressure, but upticks under 1.3513 (Nov 18 lower top) would provide better levels to re-enter bearish market, for renewed attack at weekly cloud base and attempt towards 1.3164/1.3154 (Fibo 38.2% of 1.1409/1.4249 / 200WMA).

Only sustained break above 1.3500 zone would provide relief and allow for stronger correction.

Res: 1.3340; 1.3370; 1.3401; 1.3438

Sup: 1.3276; 1.3250; 1.3194; 1.3164