Recovery loses traction, keeping in play risk of bearish continuation

Cable eases on Thursday following repeated rejection on approach to 1.3200 barrier, signaling that fresh bulls might be running out of steam.

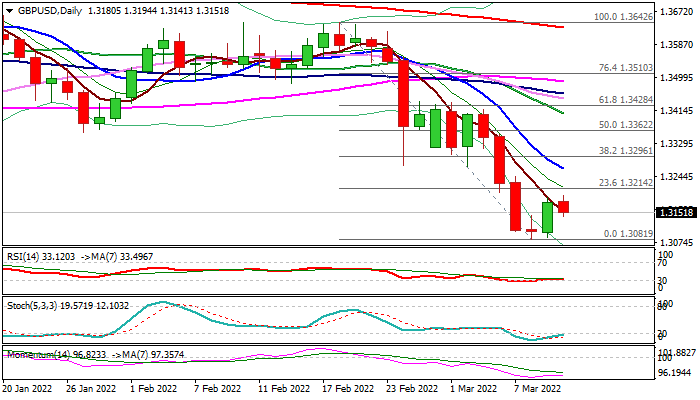

Initial signal of reversal on formation of Doji reversal pattern failed to get a confirmation on extension above 1.3214 (Fibo 23.6% of 1.3642/1.3081 bear-leg), warning that recovery was short-lived and larger bears are about to re-take full control.

Daily studies support this scenario as 14-d momentum remains deeply in the negative territory and full bearish setup of daily MA’s stays intact, however, bears need to register weekly close below key supports at 1.3164/20 (Fibo 38.2% of 1.1409/1.4249 / cracked 200WMA) to confirm bearish stance generate initial signal of bearish continuation.

Violation of new multi-month low at 1.3081 (the lowest since Nov 2020) would open way towards psychological 1.30 support and 1.2829 (50% retracement of 1.1409/1.4249) in extension.

Initial resistances lay at 1.3194/1.3214, followed by falling 10DMA (1.3265), but only sustained break above former strong support at 1.3300 zone (broken Fibo 76.4% of 1.3161/1.3748 / Fibo 38.2% of 1.3642/1.3081 bear-leg) would sideline larger bears.

Res: 1.3194; 1.3214; 1.3265; 1.3300

Sup: 1.3124; 1.3081; 1.3000; 1.2950