Recovery stays capped under pivotal barriers ahead of key events

The Euro holds within narrow range ahead of today’s key events, ECB, Fed minutes and Brexit decisions, which are expected to give fresh direction signals.

The European Central Bank policy meeting might be a non-event as the policy remains unchanged and similar rhetoric from the previous meeting in emphasizing downside risk is expected from Mario Draghi.

More action could be expected from EU summit’s Brexit decisions, as well as US CPI data and Fed minutes.

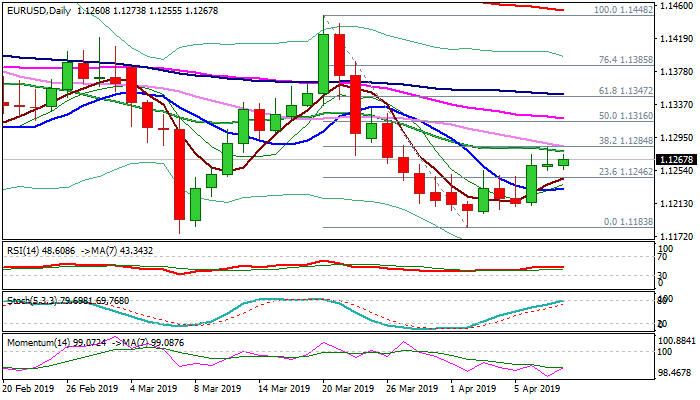

Recent recovery on profit-taking after past three-weeks fall was so far seen as adjustment as the action was capped by key barriers at 1.1280 zone (20SMA / Fibo 38.2% of 1.1448/1.1183).

Tuesday’s Doji with long upper shadow adds to negative signals from bearish momentum and stochastic penetrating overbought zone.

Repeated failure at 1.1280 zone barriers would signal recovery stall, with return and close below 10SMA (1.1231) needed to confirm reversal and shift focus lower.

Bullish scenario requires sustained break above 1.1280 to signal further recovery and expose next significant barriers at 1.1319 (55SMA / near 50%) and 1.1348 (100SMA / Fibo 61.8% of 1.1448/1.1183).

Res: 1.1284; 1.1319; 1.1348; 1.1385

Sup: 1.1255; 1.1244; 1.1231; 1.1200