Recovery struggles at 1.2700 zone; UK Services PMI in focus

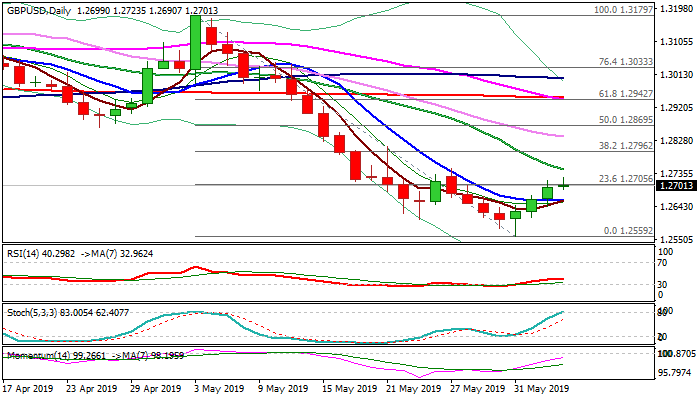

Cable is trading within narrow range in early Wednesday’s trading and showing signs of stall of three-day recovery leg from 1.2559 low, as bulls face strong headwinds from 1.2700/08 barriers (round-figure / Fibo 23.6% of 1.3179).

Tuesday’s action closed below 1.2700 handle despite upticks to 1.2714, with similar picture seen in early European trading on Wednesday.

Conflicting daily indicators (north-heading momentum / overbought stochastic / sideways- moving RSI and mixed setup of MA’s) add to scenario.

Mild immediate reaction was seen on speech from BoE’s Ramsden, with focus on UK Services PMI data (May 50.6 f/c vs 50.4 prev).

Any surprise under 50 threshold would increase pressure on sterling and risk stronger signal of recovery stall.

Conversely, upbeat results could boost pound in addition to dovish Fed deflated the greenback.

Res: 1.2723; 1.2746; 1.2796; 1.2810

Sup: 1.2690; 1.2662; 1.2610; 1.2559