Renewed Brexit doubts weaken n/t structure and signal deeper pullback

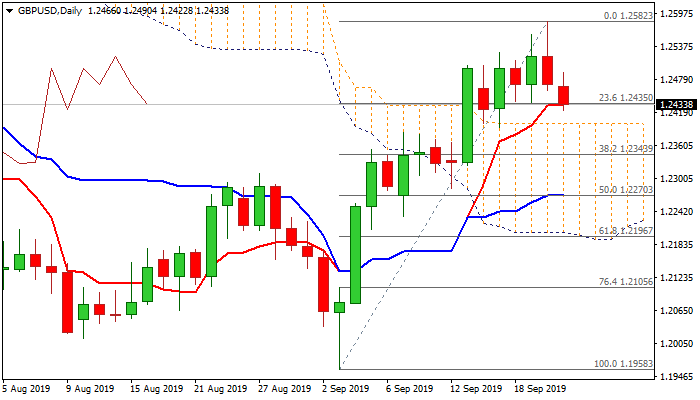

Cable stands at the back foot and cracks pivotal supports at 1.2438/37 (double-bottom of 18/19 Sep, reinforced by rising 10DMA), following last Friday’s strong upside rejection at 1.2582 (new 11-week high) and subsequent quick pullback.

Bulls were hurt by fresh doubts over possible progress in Brexit talks that was advertised last week by top EU and UK officials, as PM Johnson expressed his doubts over breakthrough in talks with EU leaders in New York, with Irish backstop being the key obstacle in talks.

Friday’s close in red and below cracked pivots at 1.2483 (100DMA) and 1.2501 (Fibo 38.2% of 1.3381/1.1958) after short-lived probe above and early Monday’s action being capped by falling 100DMA, softens near-term tone.

Firm break below 1.2438/37 would signal further easing and expose next key support at 1.2399 (daily cloud top) violation of which would signal deeper pullback and expose supports at 1.2343 (Fibo 38.2% of 1.1958/1.2582 upleg) and 1.2325 (rising 20DMA).

Daily indicators (momentum / stochastic / RSI) turned south and support scenario as weekly close in long-legged Doji signaled indecision after strong rally in previous two weeks, adding to negative signals.

Only return and close above 100DMA and Fibo barrier at 1.2501 would sideline downside threats.

Res: 1.2435; 1.2480; 1.2501; 1.2526

Sup: 1.2399; 1.2384; 1.2343; 1.2325