Renewed trade tensions and weak China’s data keep Aussie at the back foot

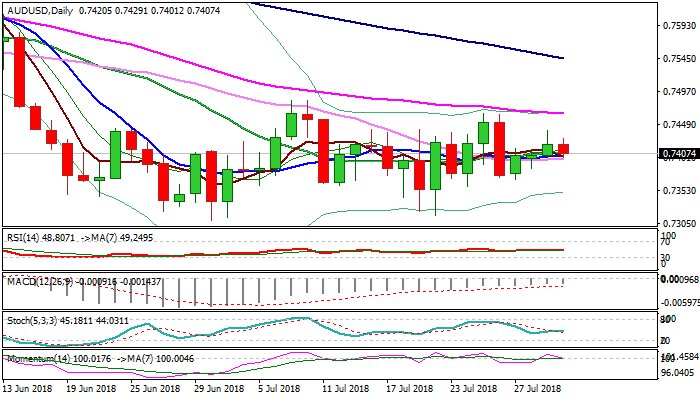

The Australian dollar holds in red on Wednesday after three-day rally stalled at previous strong barrier at 0.7440 zone, weighed by renewed trade concerns and lower than expected China’s Manufacturing PMI in July.

Strong rejection on Wednesday that left daily candle with long upper shadow suggests that bulls might be running out of steam.

The notion is supported by weakening momentum and probe below a cluster of converged daily MA’s, clear break of which would be negative signal (30SMA marks the lower boundary at 0.7400) for extension towards next strong supports at 0.7370 (26/27 July higher lows)

Increasing trade tensions between the US and China would put the pair under stronger pressure and shift near-term focus higher.

On the other side, bullish scenario requires initial signal on sustained break above 0.7440, with confirmation on lift above 0.7465 (25/26 July tops / 55SMA) and 0.7483 (09/10 July highs).

Res: 0.7440; 0.7465; 0.7483; 0.7500

Sup: 0.7400; 0.7385; 0.7370; 0.7359