Sterling awaits verdicts from the central banks for stronger direction signals

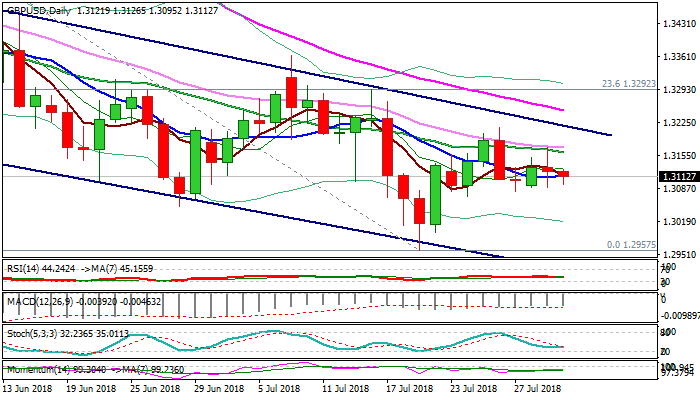

Cable moved higher in early European trading after fall to 1.3095 in Asia found footstep just above strong support at 1.3085 zone (Higher base / 50% of 1.2957/1.3213).

Better than expected UK house price data helped pound but positive sentiment was soured by UK Manufacturing PMI which fell below expectations in July.

Daily techs send negative signals as momentum is weak and falling MA’s are in bearish setup.

Tuesday’s Doji signals indecision ahead of Thursday’s BoE rate decision, with today’s action expected to remain in similar mode.

Bank of England is widely expected to raise interest rates by 0.25%, in ‘dovish hike’, which would support sterling, but the question is how much sterling would advance as overall picture is bearish and the pair holds within nearly three-month bear-channel.

On the other side, pound could be hit strongly if BoE opts for unchanged rates and would accelerate towards 1.3000 and 1.2957 supports.

Res: 1.3126; 1.3173; 1.3217; 1.3250

Sup: 1.3085; 1.3055; 1.3000; 1.2957