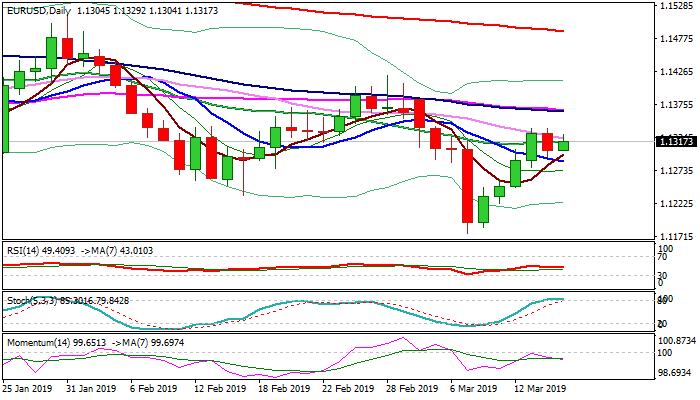

Repeated close above key Fibo barrier to signal recovery extension

The Euro regained traction on Friday and recovered the most of Thursday’s 1.1337/1.1294 dip after four-day rally stalled at falling 30SMA.

Thursday’s close in red and failure to repeatedly close cracked Fibo barrier at 1.1326 (38.2% of 1.1569/1.1176) softened near-term structure, though bullish bias is expected to remain intact while 10SMA (1.1287) holds the downside.

However, risk of recovery stall and possible pullback would increase on another failure to clearly break 1.1326 barrier and repeated close below falling 30SMA (1.1322), as momentum is weak and stochastic in overbought territory.

EU benchmark CPI ticked higher in Feb, according to the expectations and supporting the pair, with a series of data from the US, due later today and news about Brexit, eyed for fresh signals.

Weekly close above 1.1326 Fibo barrier would generate bullish signal for extension of recovery leg from 1.1176 (2019 low) and expose barriers at 1.1365/72 (converged 55/100SMA’s / 50% of 1.1569/1.1176).

Conversely, close below 10SMA would be initial negative signal for deeper correction of 1.1176/1.1338 upleg.

Res: 1.1322; 1.1338; 1.1369; 1.1382

Sup: 1.1304; 1.1287; 1.1276; 1.1257