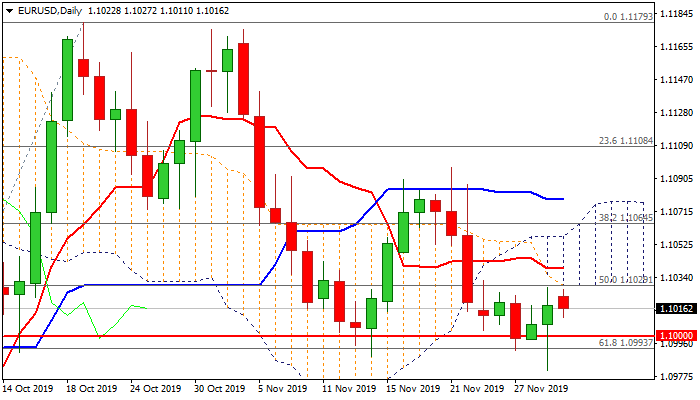

Repeated failures at key sup/res levels keep the pair in directionless near-term mode

The Euro stands at the back foot in early Monday’s trading following strong downside rejection on Friday, as short-lived probe below key 1.1000/1.0989 support zone left daily candle with long tail.

Attempts to extend recovery were capped by the base of thickening daily cloud (1.1029) which continues to weigh and conflict positive signals from multiple failure at key supports and improving daily techs (stochastic is rising after reversal from oversold zone and momentum is breaking into positive territory).

Near-term action remains biased lower for renewed attack at 1.10 zone as daily MA’s in bearish setup created several bear-crosses, adding to bearish pressure.

However, the pair may remain in extended sideways mode between two key obstacles if bears or bulls fail to gain full control and wait for fresh signals.

Bearish scenario on firm break of 1.1000/1.0989 would signal continuation of larger downtrend towards targets at 1.0949 (Fibo 76.4% of 1.0878/1.1179) and 1.0940 (8 Oct trough).

Conversely, break of daily cloud top would activate bullish scenario, but more work at the upside (break of Fibo 61.8% of 1.1096/1.0981 at 1.1052 and daily cloud top at 1.1057) will be required to signal reversal.

Res: 1.1029; 1.1039; 1.1052; 1.1057

Sup: 1.1011; 1.1000; 1.0981; 1.0949