Repeated recovery rejections keep the price in directionless n/t mode

The Euro ticks higher in early Monday’s trading but remains within choppy range that extends into fourth straight day.

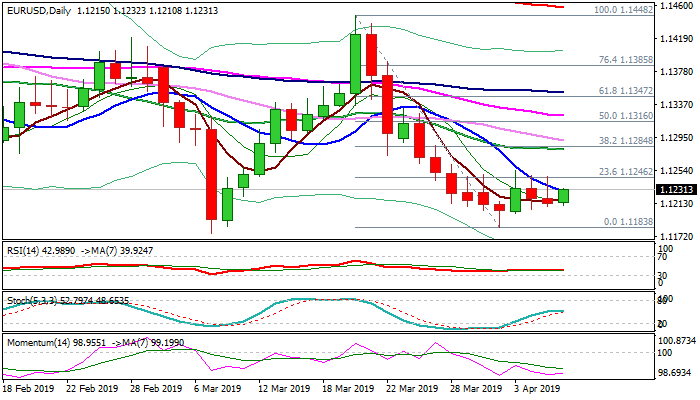

Recovery attempts following last week’s hammer candle (2 Apr) were so far unable to clearly break initial barrier at 1.1246 (Fibo 23.6% of 1.1448/1.1183), leaving series of daily candles with long upper shadows that signal bulls are lacking strength.

Bearish momentum and flat stochastic give unclear signal on daily chart, suggesting that extended consolidation is likely to precede fresh weakness, as falling 10SMA (1.1227) continues to cap and now marks initial resistance.

Immediate risk is expected to remain shifted lower while the price action holds below 10SMA / Fibo 23.6% barriers, for renewed attack at key supports at 1.1186/76 (cracked Fibo 61.8% of 1.0340/1.2555 / 7 Mar low).

Bears might be sidelined if recovery manages to break higher, however, stronger bullish signal could be expected only if the price rallies above 1.1280/84 pivots (20SMA / Fibo 38.2% of 1.1448/1.1183).

The ECB is meeting this week, with EU summit regarding Brexit, US-China trade talks and US inflation data, being in focus for fresh signals.

Res: 1.1246; 1.1280; 1.1284; 1.1316

Sup: 1.1210; 1.1200; 1.1186; 1.1176