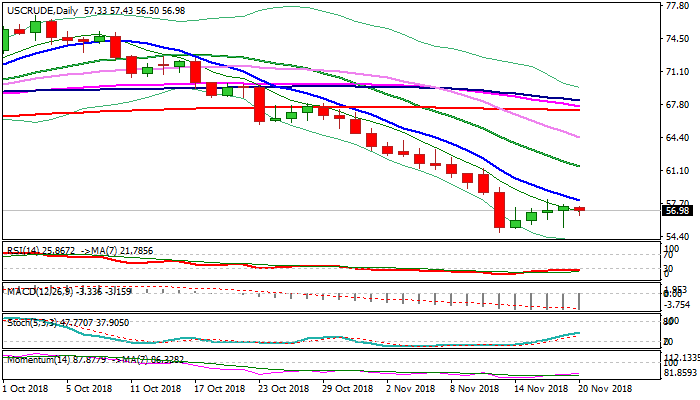

Repeated upside rejection under 10SMA and Monday’s Hanging Man are negative signals

WTI oil price eases on Tuesday, signaling that near-term corrective phase off $54.74 (new one-year low, posted on 13 Dec) might be running out of steam after being repeatedly rejected under pivotal barrier provided by falling 10SMA.

Monday’s Hanging Man candle adds to negative signals, along with strongly bearish sentiment in the market which so far offsets positive signals for possible output cut by main world oil producers.

Traders remain strongly concerned about global supply as the US production rose nearly 25% this year and hit record of 11.7 million barrels per day, while impact from US sanctions to Iran was minimal so far, as the US allowed some of big importers to continue buying oil from Iran after the sanctions started in early Nov.

Oil remains under strong pressure and may extend 1 ½ year fall with sustained break below cracked pivot at $55.35 (Fibo 61.8% of $42.04/$76.88) needed to generate bearish signal for continuation of downtrend from $76.88 (03 Oct high).

Falling 10SMA ($58.03) marks pivotal barrier, break of which would signal stronger recovery and put larger bears on hold.

Res: 58.04; 59.33; 59.97; 61.49

Sup: 56.50; 56.11; 55.35; 54.74