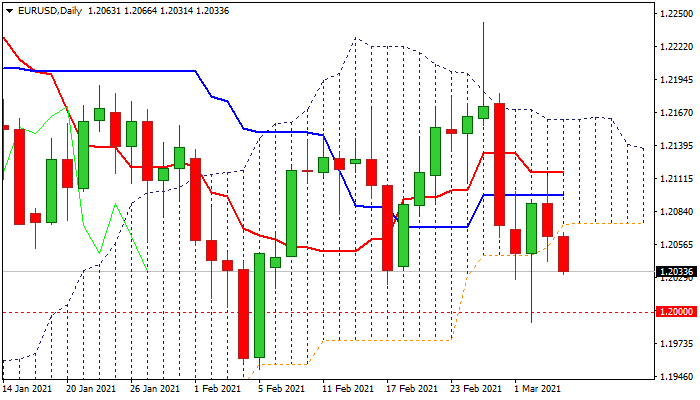

Return below thick daily cloud brings bears back to play

Near-term structure weakens further on Thursday as fresh bears gain pace and return below daily cloud base (which contained Wednesday’s dip), offsetting positive signal from Tuesday’s strong downside rejection (long tail of daily candle) and subsequent bounce that was capped by a cluster of converging daily moving averages (10,20,30DMA’s).

Fresh extension lower turns near-term bias turns to the downside and bring in focus 100DMA (1.2027), break of which would open way for retest of psychological 1.2000 support.

Rising bearish momentum on daily chart supports the action, weighed by thick daily cloud (1.2074/1.2161), with near-term bias to remain negative while the action remains capped by cloud base.

Only return above 1.21 resistance zone would be a game changer.

Res: 1.2063; 1.2074; 1.2097; 1.2117

Sup: 1.2020; 1.2000; 1.1991; 1.1952