Reversal pattern is forming on daily chart and threatening of deeper pullback

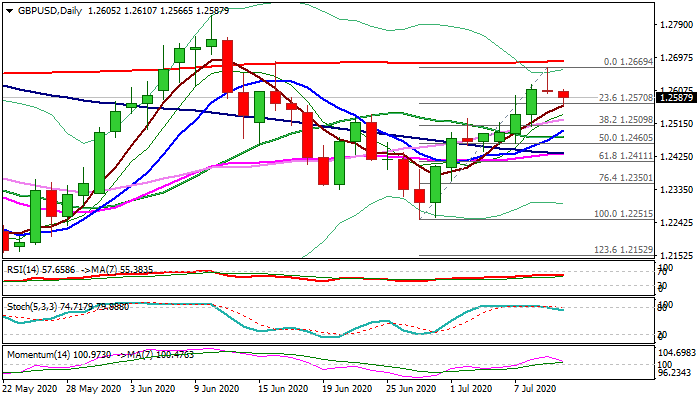

Cable stands at the back foot on Friday but pullback from new three-week high (1.2669) was so far contained by Fibo 23.6% retracement of 1.2251/1.2669 upleg / 5DMA (1.2570).

Risk sensitive pound was strongly pressured by fall in stock markets, with persisting differences between two sides in EU/UK talks, adding pressure.

Thursday’s Doji with very long upper shadow and fresh extension lower on Friday are on track to form reversal pattern on daily chart and risk deeper pullback towards pivotal supports at 1.2500 zone (Fibo 38.2% of 1.2251/1.2669 / rising 10DMA).

Fading bearish momentum and daily stochastic heading south after forming bearish divergence and emerging from overbought territory, are also negative signals.

On the other side, weekly studies remain bullishly aligned as the pair is on track for the second positive weekly close that may influence fresh weakness.

Res: 1.2610; 1.2623; 1.2669; 1.2687

Sup: 1.2570; 1.2527; 1.2509; 1.2495