Rising risk appetite drives Aussie further up

The Australian dollar advances further on Wednesday, boosted by fresh risk appetite in the market after news about cure for coronavirus circulated and extends recovery into third straight day.

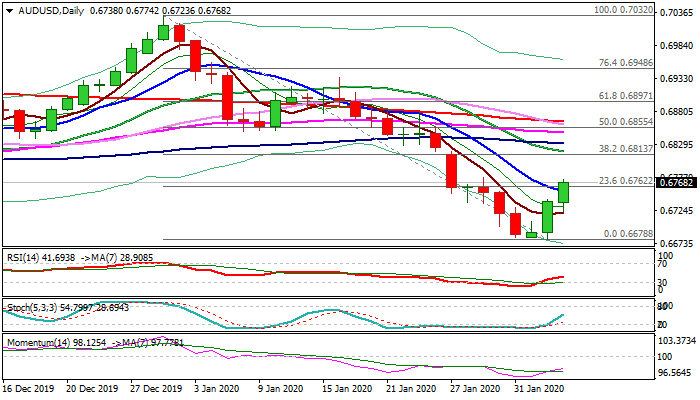

Fresh bullish extension broke above initial barriers at 0.6754/62 (10DMA / Fibo 23.6% of 0.7032/0.6678) after Tuesday’s rally (the biggest one-day gains since 11 Dec) completed inverted hammer reversal pattern on daily chart.

North-heading daily indicators (momentum, stochastic, RSI, support scenario, which requires firm break above 0.6762 to expose pivotal barriers at 0.6813/17 (Fibo 38.2% / 10DMA), violation of which would generate stronger reversal signal.

Overbought 4-hr studies warn that bulls may take a breather before resuming, with 4-hr Tenkan-sen/Kijun-sen bull-cross (0.6726) underpinning and expected to contain dips.

Res: 0.6774; 0.6800; 0.6817; 0.6830

Sup: 0.6754; 0.6723; 0.6678; 0.6670