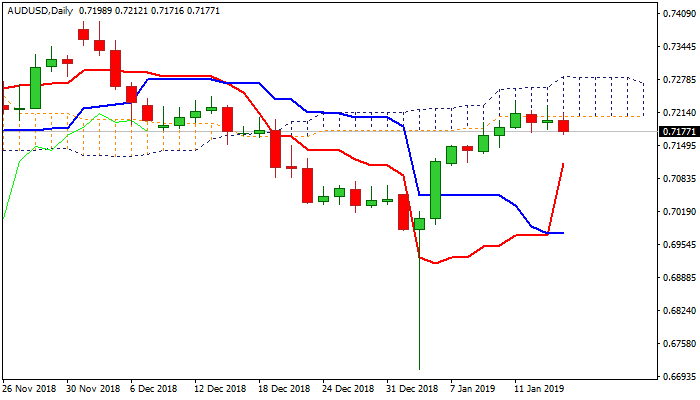

Risk of pullback increases after repeated failures at daily cloud base

The Australian dollar probes through 55/100SMA support zone (0.7196/76) on fresh weakness triggered by stronger greenback.

Multiple rejections at daily cloud base (0.7207) in past few sessions signaled that recovery rally from 3 Jan spike low at 0.6706 is running out of steam.

The notion is supported by south-turned RSI and momentum, as slow stochastic is heading lower after reversal from overbought territory.

Close below 100SMA would generate initial bearish signal for extension towards 10SMA (0.7154), but stronger reversal signal could be expected on extension and close below 0.7110 (20SMA / Fibo 23.6% of 0.6706/0.7235 rally).

Thick daily cloud (0.7207/0.7282) marks strong obstacle and sustained break above cloud would provide stronger bullish signal for extension towards falling 200SMA (0.7327).

Res: 0.7212; 0.7235; 0.7282; 0.7327

Sup: 0.7154; 0.7110; 0.7033; 0.7000