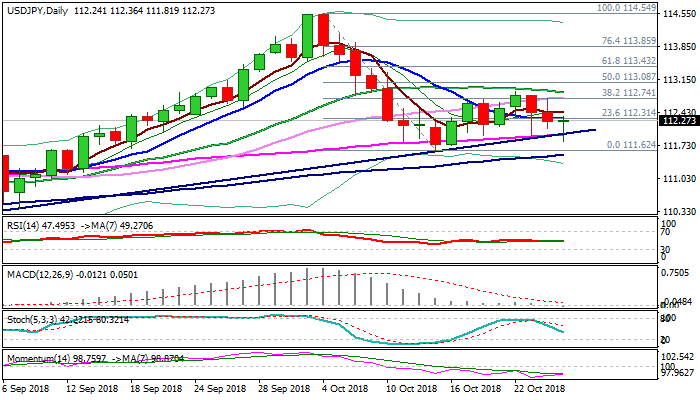

Risk of reversal after bears failed at key supports

The pair extended weakness to 111.81 on Thursday, as yen benefited from recent risk aversion, but probe through key supports at 111.96 (rising 55SMA / trendline support) were so far short-lived, despite magnetic daily cloud twist (111.47).

Subsequent bounce signals that bears might be running out of steam, as momentum heads up and partially offsetting negative impact from bearish MA’s / slow stochastic.

Today’s close would provide more clues, as current long-tailed Doji or hammer could signal reversal.

Recovery needs sustained break above 10SMA (112.32) to sideline downside risk and generate bullish signal for further retracement of 112.88/111.81 bear-leg.

Conversely, stronger bearish signal could be expected on close below 55SMA / bull-trendline, which would expose key supports at 111.64/62 (daily cloud top / 15 Oct low) and risk further weakness on break.

Res: 112.32; 112.64; 112.74; 112.85

Sup: 112.08; 111.96; 111.81; 111.62