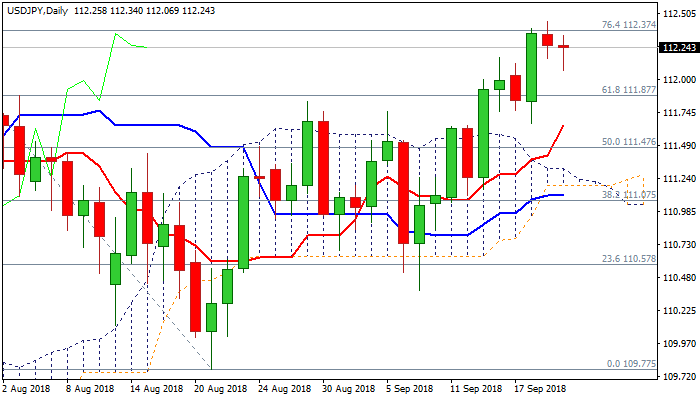

Risk of reversal increases after repeated failure at 112.37 Fibo barrier

Risk of reversal is growing after bulls repeatedly failed to close above cracked Fibo barrier at 112.37 (76.4% of 113.17/109.77 descend) with Wednesday’s trading ending in red and extended dips on Thursday penetrating rising thick hourly cloud which underpins near term action.

Overbought daily slow stochastic and south-turning momentum add to negative signals, along with twist of daily cloud early next week, which could also attract.

Further bearish signal could be expected on break below 111.95 (Fibo 23.6% of 110.38/112.44 upleg), with confirmation of reversal seen on extension and close below pivots at 111.76/67 (rising 10SMA / Fibo 38.2% of 110.38/112.44).

To neutralize bearish threats, strong rally and eventual close above 112.37 pivot is needed.

Res: 112.37; 112.44; 112.62; 112.92

Sup: 112.06; 111.95; 111.76; 111.67