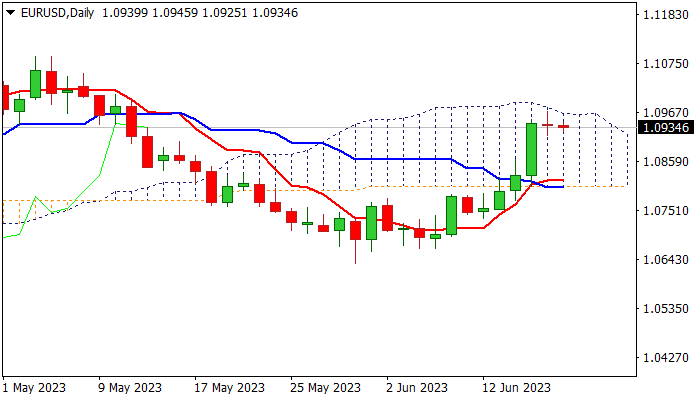

Shallow correction likely to precede fresh push higher

The Euro edged lower in early Monday, adding downside risk after Friday’s long-legged Doji signaled strong indecision.

Last week’s rally (nearly 1.8% up for the week) accelerated strongly on Thursday on hawkish ECB but faced strong headwinds on approach to the top of thick daily cloud (1.0964).

Traders are likely to collect some profits after recent strong acceleration higher for price adjustment ahead of fresh push higher, as overall sentiment remains positive and completion of reversal pattern on weekly chart adds to bullish signals.

Fading bullish momentum on daily chart and overbought stochastic, contribute to reversal signals, although the pullback is likely to be limited, with solid supports at 1.0891/81 (Fibo 23.6% of 1.0635/1.0970 / 55DMA), guarding pivot at 1.0842 (Fibo 38.2% retracement) which should contain extended dips and keep larger bulls in play.

Res: 1.0964; 1.0983; 1.1000; 1.1053

Sup: 1.0917; 1.0881; 1.0842; 1.0811