Sideways mode between key levels extends into fourth straight day

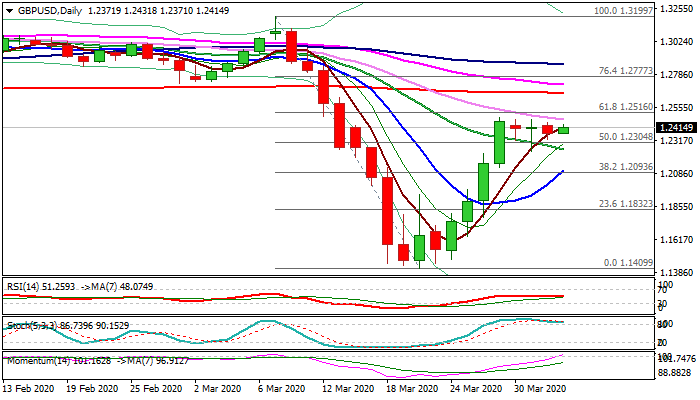

Cable remains congested for the fourth straight day, lacking direction signal, as the upside remains capped by thick weekly cloud, while strong bids at 1.2304 (broken Fibo 50% level) and 1.2256 (20DMA) keep the downside limited.

Fresh bullish momentum on daily chart underpins, but overbought stochastic and flat RSI add to obstacles.

Expect directionless mode to extend while the price action holds within key levels at 1.2419 (weekly cloud base) and 1.2516 (Fibo 61.8% of 1.3199/1.1409) at the upside and 1.2304/1.2256 at downside.

Break of either side would generate fresh direction signal, with break higher to expose 200DMA (1.2652), while close below 20DMA would risk dip towards 10DMA (1.2104) and Fibo 38.2% of 1.1409/1.2485 (1.2074).

Res: 1.2466; 1.2485; 1.2516; 1.2624

Sup: 1.2371; 1.2304; 1.2256; 1.2242