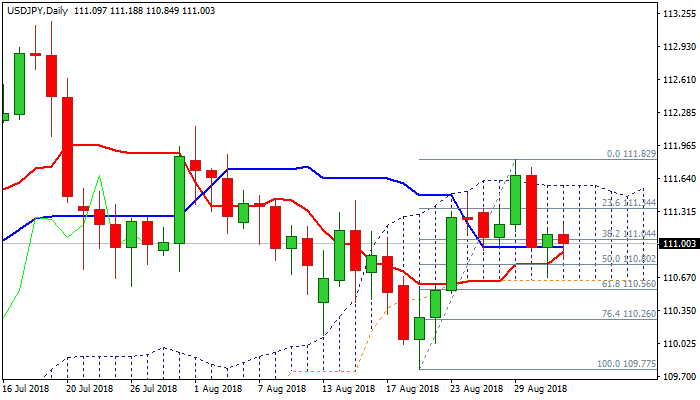

Sideways mode could extend due to thin holiday markets; daily cloud base marks key support

The pair trades within narrowing range on Monday, holding in the middle of thick daily cloud, following strong downside rejection at cloud base (110.64) last Friday.

Mixed signals from daily techs suggest no clear near-term direction, but risk is skewed lower as momentum is weakening and crossing into negative territory.

Cloud base (110.64) and Fibo 61.8% of 109.77/111.82 (110.56 mark key supports, break of which would generate bearish signal for extension of pullback from last week’s peak at 111.82.

Falling thick hourly cloud (111.00/25) weighs on near-term action and is expected to cap.

Extended sideways mode could be expected on thinner markets due to US holiday.

Res: 111.18; 111.57; 111.83; 112.15

Sup: 110.84; 110.64; 110.56; 110.36