Signals of hawkish Fed and bullish techs keep the dollar supported

The dollar regained traction in early US session on Wednesday, after closing in red previous day, slightly deflated by a lack of more hawkish tones from Fed chair Powell that markets widely expected, though he acknowledged that rates may need to move higher than expected, in central bank’s attempts to curb high inflation

However, the pause after strong three-day rally is likely to be short-lived as market speculate that the Fed may opt for a massive hikes by a cumulative 100-125 basis points in coming months, as stronger than expected labor markets threatens to slow Fed’s efforts to bring soaring prices under control.

In such scenario, which now looks quite possible, it would overshoot current expectations for a terminal rate at 5.00% -5.25% towards possible 5.75%-6.00% range that would offer fresh and strong support to dollar.

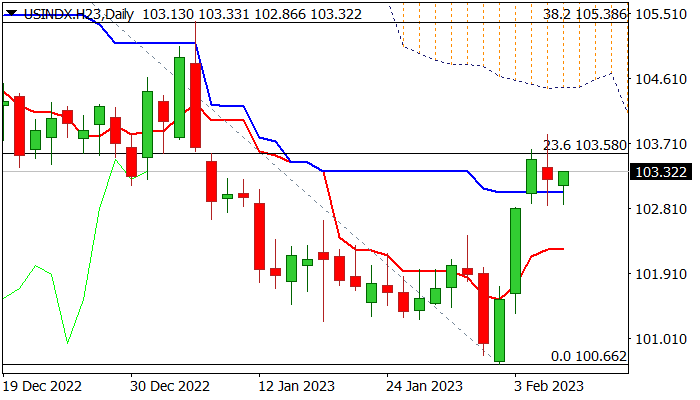

Technical studies on daily chart maintain strong bullish momentum and the outlook was boosted by completion of Three White Soldiers bullish pattern, which signals that the recent rally would extend further after consolidation.

Current overall positive picture suggests dip-buying as favored scenario, with solid support seen at 103.03 (daily Kijun-sen) which keeps the downside protected for the third straight day, guarding lowed pivot at 102.24 (daily Tenkan-sen).

Bulls eye initial target at 104.49 (base of thick daily cloud), but may extend towards 105.40 (Jan 6 lower top) on break.

Res: 103.83; 104.49; 105.40; 106.31

Sup: 103.03; 102.85; 102.24; 101.36