Solid US data lift dollar but risk of deeper correction exists

The dollar regained traction on Thursday, lifted by solid US economic data (weekly jobless claims matched last week’s figure and Philadelphia Fed manufacturing index surged to two year high in April, strongly beating previous release and forecast).

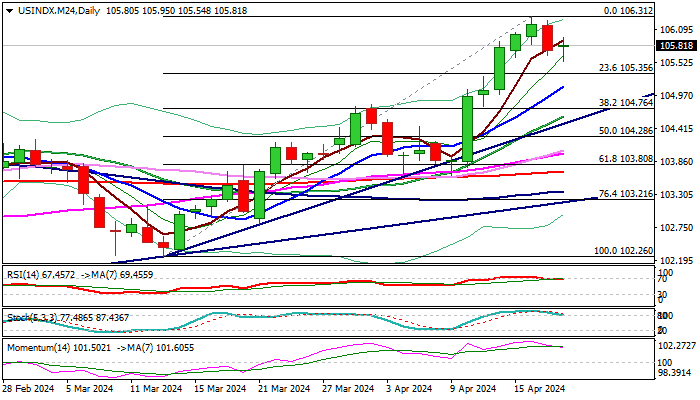

The greenback edged higher from one-week low (105.54), posted in extension of Wednesday’s 0.4% drop on pullback from multi-month high (106.31).

Overall technical picture on daily chart is bullish, though overbought conditions and headwinds that bulls face from the top of weekly Ichimoku cloud (106.11) might be an obstacle.

Pullback from new top was so far shallow and find footstep well above initial supports at 105.35/14 (Fibo 23.6% of 103.21/106.31), but risk of a deeper correction still exists, as initial reversal signal is developing on weekly chart.

There is still enough space for further easing, with extension below 105.35/14 levels to expose strong supports at 104.76/66 (Fibo 38.2% / trendline support), where extended dips should be contained to mark a healthy correction and keep larger bulls in play.

Res: 105.95; 106.31; 107.00; 107.88

Sup: 105.54; 105.35; 105.14; 104.76