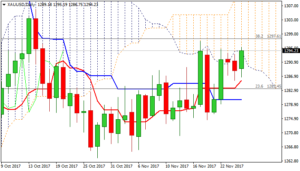

SPOT GOLD – daily cloud base continues to cap near-term action

Spot Gold maintains bullish bias on weaker dollar and concerns about Fed’s next steps regarding interest rates, but upside attempts were repeatedly limited.

Recovery faces very strong resistance, provided by the base of widening daily cloud which repeatedly resisted several attacks last week.

Firmly bullish daily techs suggest further upside and test of $1297 (Fibo 38.2% of $1357/$1260 descend) and psychological $1300 barrier, which requires firm break above cloud base (1294).

Stronger bullish acceleration would expose another key barrier at $1309 (daily cloud top / 50% retracement) break of which is needed to confirm bullish continuation.

Conversely, repeated close below daily cloud would signal further extension of near-term congestion and also keep the downside at risk.

Res: 1297; 1300; 1306; 1309

Sup: 1286; 1283; 1281; 1274