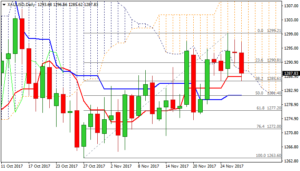

SPOT GOLD eases below daily cloud as greenback rallies after Yellen

Spot Gold dipped below daily cloud after Fed Yellen’s remarks inflated dollar, which received further support on better than expected US q3 GDP numbers (3.3% vs 3.2% f/c). Fresh bearish acceleration and extension through cloud base weakened near-term structure, seeing increased risk of further easing.

Initial negative signal was generated on Monday’s strong rejection just ahead of psychological $1300 barrier and Tuesday’s Doji candle.

Close below daily cloud today would be additional bearish signal for further retracement of $1263/$1299 recovery leg.

Bearish acceleration found footstep at $1285 (Fibo 38.2% of $1263/$1299) which marks next pivot.

Break here would open $1281 (50% retracement / daily Kijun-sen) and $1277 (Fibo 61.8%) in extension.

Broken cloud base marks immediate resistance at $1288, with return and close in the daily cloud expected to ease bearish pressure.

However, stronger recovery needs to regain session high at $1296 to shift near-term focus higher again.

Res: 1288; 1290; 1296; 1299

Sup: 1287; 1285; 1281; 1277