SPOT GOLD extends sharp fall on Monday and pressures strong supports at $1319/18

Strong bearish acceleration on Monday extends steep fall of last Thu/Fri, marking so far near 1% loss for the day.

Fresh bears broke through thin daily cloud and pressure strong supports at $1319/18 (06 Apr low / rising 100SMA).

Stronger dollar on rising US bond yields and eased geopolitical tension that slashed safe-haven demand, keep the yellow metal under strong pressure.

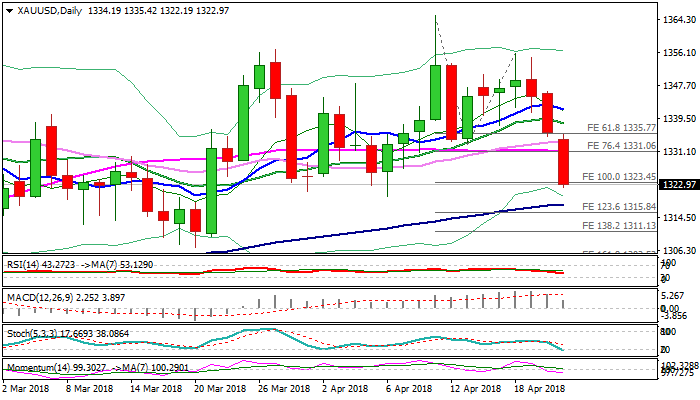

Daily techs turned to bearish mode and favor further downside, as gold price rides on the third wave of five-wave sequence from $1365 high and cracked its FE 100% at $1323.

The wave could travel to its FE123.6% at $1315, on break below $1319/18 pivots and could extend to $1311 (FE 138.2%).

Bears may show hesitation at $1319/18 zone on oversold conditions, but strong bearish sentiment suggests limited upside action.

Daily cloud is widening after last week’s twist, currently spanned between $1329 and $1334 and should cap corrective upticks.

Res: 1323; 1329; 1331; 1334

Sup: 1318; 1315; 1311; 1307