Spot gold falls on fresh risk appetite

Spot gold dipped well below $1500 mark on Monday after news about significant progress in US/China trade talks boosted risk sentiment.

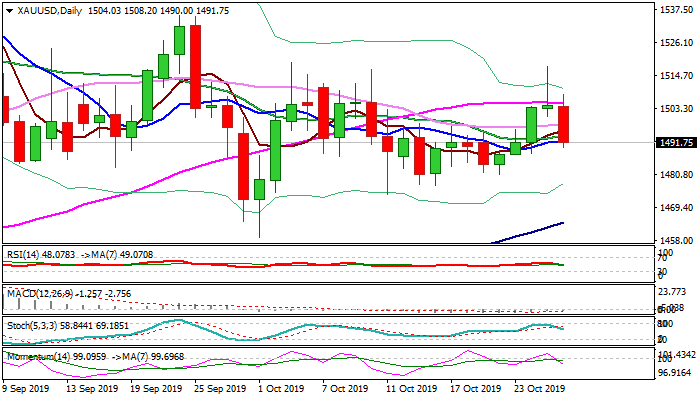

Fresh weakness is on track to complete reversal pattern on daily chart, formed after strong rally last Thursday, strong upside rejection on Friday (which failed on probe above daily cloud top and left daily Doji with long upper shadow) and today’s long bearish candle.

Weakening daily studies on MA’s turning to bearish setup, momentum breaking into negative territory and south-heading stochastic, work in favor of further weakness.

Traders are cautious ahead of Wednesday’s Fed policy meeting (wide expectations for the third consecutive rate cut this year but likely the last one in 2019) as rate cut is generally supportive factor for the yellow metal, but see limited reaction on such scenario.

On the other side, fresh risk mode on rising optimism for US/China trade deal, rallying stocks and Brexit extension that reduces risk of no-deal scenario, would significantly reduce safe-haven demand.

Today’s close below $1496/97 (Fibo 38.2% of $1459/$1519 / converged daily Tenkan/ Kijun-sen) would add to negative signals for extension towards next key supports at $1482 (Fibo 61.8%) and $1478 (daily cloud base).

Res: 1496; 1500; 1508; 1511

Sup: 1490; 1487; 1482; 1478