SPOT GOLD – fresh attempts higher as sentiment sours on renewed fears about trade war

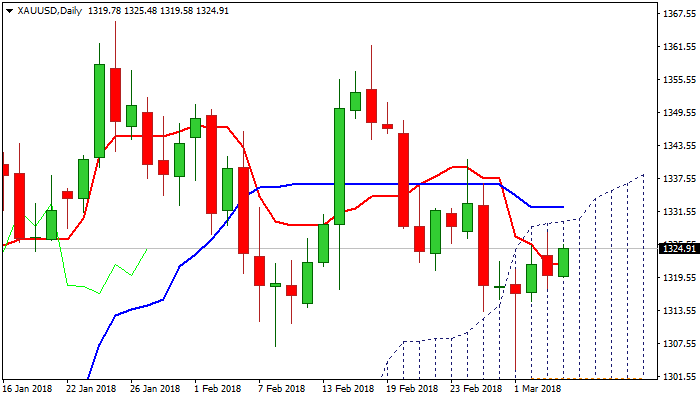

Spot Gold moved higher on Tuesday, probing again above initial barrier at $1323 (10SMA), as uncertainty on US tariffs keeps dollar’s sentiment sensitive.

Traders remain cautious as fears of possible trade war remain alive, as pressure rises on President Trump to pull back from proposed tariffs plan.

Investors are returning to risk-off mode on persisting uncertainty and could push gold price higher if sentiment sours further.

Fresh upside pressures cracked pivot at $1326 (Fibo 61.8% of $1340/$1302 bear-leg), firm break of which would generate bullish signal and open way for test of next pivot at $1329 (daily cloud top).

Technical picture remains mixed as bearish momentum is building, MA’s are in mixed mode while slow stochastic heads north and showing space for further advance.

Lift above $1326/29 pivots is needed to improve the picture and signal further advance.

Cracked 10SMA marks immediate support at $1323, while return below $1322 (rising 55SMA) would generate negative signal.

Res: 1326; 1329; 1333; 1336

Sup: 1324; 1322; 1315; 1307