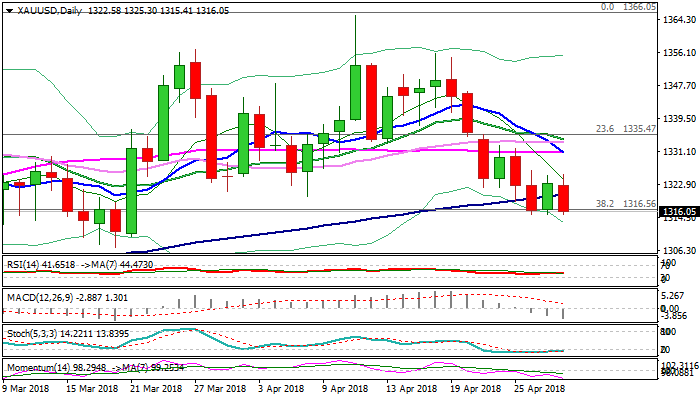

SPOT GOLD – fresh bears pressure $1315 base and could extend towards key supports at $1307/03

Gold price fell on Monday and fully reversed last Friday’s recovery to $1325, as fresh weakness retested new five-week low at $1315, posted last Thursday.

Easing geopolitical tensions over Koreas, as peace talks progress, reduced demand for safe-haven assets, while dollar regained traction on Monday after pulling off recent highs last week, bringing gold price under renewed pressure.

Daily techs returned to full bearish setup after short-lived probes above 100SMA, while falling 10SMA formed multiple bear-crosses (20;30;55SMA) and momentum continues to head lower, keeping bearish structure intact for eventual push towards key supports at $1307/03 (20 Mar low / 200SMA).

Weakening daily studies show increased risk for break below pivotal $1307/03 zone which also marks the lows of short-term $1303/66 congestion) which would confirm reversal and open way for further retracement of $1236/$1366 ascend.

Close below $1315 base (also Fibo 38.2% of $1236/$1366 rally) is seen as initial requirement for bearish scenario.

Broken 100SMA marks initial resistance at $1320, guarding upper pivot at $1326, where recent recovery attempts were repeatedly rejected.

Res: 1320; 1326; 1331; 1334

Sup: 1315; 1310; 1307; 1303