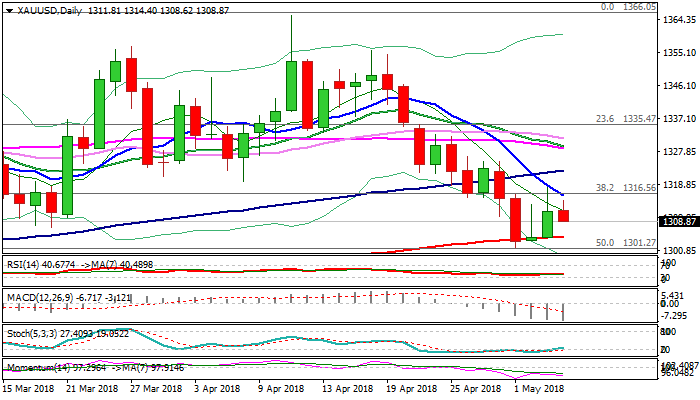

SPOT GOLD trades between 10 and 200SMA ahead of US jobs data

Gold price eased in early Friday’s trading after previous day’s rally was strongly rejected at $1318 (falling 10SMA), signaling limited recovery, following multiple downside rejections as rising 200SMA contained bear-leg from $1355 high (18 Apr).

Negative momentum and bearish setup of daily MA’s, keep broader bears intact and risk shifted lower.

Eventual break below 200SMA ($1304) and psychological $1300 support would be bearish signal for continuation of the bear-leg from $1355 towards next strong support at $1285 (Fibo 61.8% of $1236/$1366 ascend).

Bullish scenario needs close above falling 10SMA to ease existing bearish pressure and signal stronger retracement of $1355/$1301 bear-leg).

US jobs data are expected to provide stronger direction signals. Upbeat results from jobs sector in April would boost dollar and put the yellow metal’s price under increased pressure, while miss would give a breather to gold’s bears and allow for stronger correction.

Res: 1314; 1316; 1323; 1325

Sup: 1308; 1304; 1300; 1289