Sterling holds firm tone and on track for further gains on drastically improved sentiment

Cable maintains firm tone and holding near two-week high (1.2468) posted on Thursday’s 2% rally (the biggest one-day rally since mid-March).

Comments from Irish PM, following the meeting with his UK colleague that a deal could be reached by the end of the month to avert chaotic Brexit, sparked strong optimism in the market.

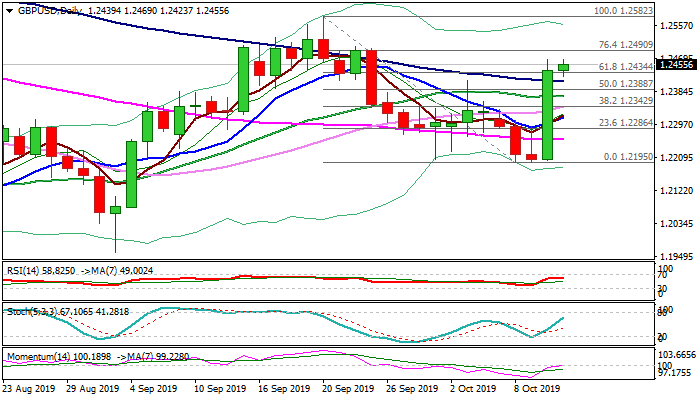

Pound soared through several important technical barriers and completed reversal pattern on daily chart, with additional bullish signal generated on daily close above 1.2434 (Fibo 61.8% of 1.2582/1.2195 bear-leg).

Thursday’s very long bullish daily candle underpins the action, along with rising bullish momentum and daily MA’s now in bullish setup.

Bulls eye initial targets at 1.2490/1.2500 (Fibo 76.4% / psychological) but could extend towards key barrier at 1.2582 (20 Sep high).

Apart from supportive techs, traders will look for more news, with meeting of chief Brexit negotiators of the EU and Britain, being the top event in early European session on Friday and positive outcome would further inflate pound.

No signs of any corrective action for now, despite strongly overbought 4-hr studies, as optimism for further progress in Brexit talks keeps traders long and not considering taking profits for now.

Broken Fibo 61.8% level (1.2434) marks initial support, followed by broken 100DMA (1.2409), loss of which would signal deeper correction.

Res: 1.2468; 1.2490; 1.2500; 1.2560

Sup: 1.2434; 1.2409; 1.2371; 1.2343