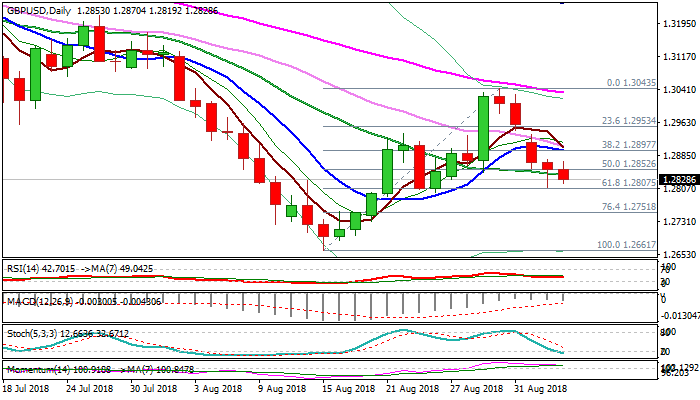

Sterling holds in red and probes again below 20SMA

Cable moves lower in Early Europe and reverses the most of 1.2810/59 recovery, offsetting positive signal from Tuesday’s hammer candle, formed after failure to clearly break 20SMA pivot (1.2840).

Persisting negative sentiment on Brexit concerns is additionally boosted by firmer dollar.

Fresh weakness through 20SMA looks for renewed attack at pivotal support at 1.2807 (Fibo 61.8% of 1.2661/1.3043 upleg) which contained Tuesday’s spike lower.

Close below here is needed to confirm reversal and lower top at 1.3043 (30 Aug high) and spark further bearish acceleration.

Weakening momentum on daily chart is crossing below its 7SMA, after formation of bearish divergence and reinforcing negative signals.

Daily MA’s are turning to full bearish setup and support scenario.

Sustained break below 1.2800 zone (Fibo support / 24 Aug trough) would open 1.2751 (Fibo 76.4%) and unmask key support at 1.2661 (15 Aug low).

Converging 5/10/30SMA’s mark solid resistance at 1.2900 zone, which is expected to cap upticks and maintains bearish bias.

Res: 1.2870; 1.2900; 1.2933; 1.2953

Sup: 1.2807; 1.2751; 1.2697; 1.2661