Sterling loses traction after BoE’s dovish hike

Cable fell sharply after the Bank of England raised interest rate by a quarter of percent that was seen as a dovish hike, as the central bank softened tone on future hikes on weakening growth outlook.

The central bank’s Monetary policy Committee voted for a hike to 0.75% from 0.5%, bringing rates back to pre-pandemic level, but with softer rhetoric about the need for more increases.

Inflation remains thee major problem and the central bank revised its outlook, expecting inflation to reach around 8% in April, almost 1% higher compared to the last month’s forecast and four times of its 2% target.

The policymakers expect inflation to rise further as prices of commodities and energies soar due to negative impact of the war in Ukraine.

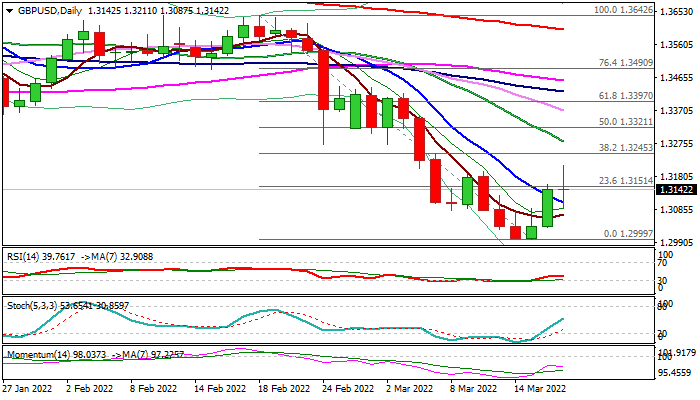

The GBPUSD dipped below 1.31 handle and hit the session low at 1.3087, on a fall from the session high at 1.3211, hit just before the BoE’s announcement.

Fresh dip weakens near-term structure and warn that two-day recovery might be over, with initial negative signal expected on repeated failure to close above initial Fibo barrier at 1.3154 (23.6% of 1.3642/1.2999 fall), while close below 10DMA (1.3105) would add to negative signals for renewed attack at psychological 1.30 support.

Bearish momentum started to strengthen on daily chart, after a brief recovery, maintaining overall bearish picture.

Res: 1.3151; 1.3211; 1.3245; 1.3281

Sup: 1.3105; 1.3087; 1.3034; 1.3000