Sterling rises after inflation data and generates initial reversal signal

Cable accelerated higher on Wednesday morning after UK inflation data showed that price pressures continue to ease, bur core inflation remains elevated and close to its record high, warning that the Bank of England would need to further raise interest rates, as inflation is still 3 ½ times above the central bank’s target.

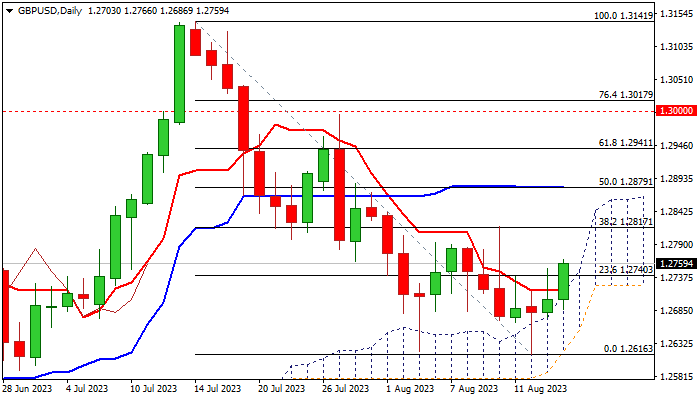

Fresh strength generates fresh signals of possible reversal after the bear-leg from 1.3141 (2023 high, posted on July 14) was contained by rising daily Ichimoku cloud.

Recent spikes (1.2620/1.2616) also form a double-bottom pattern, which needs to be verified on further gains and breach of pivotal barrier at 1.2817 (Fibo 38.2% of 1.3141/1.2616).

This would also confirm formation of higher base and open way for further recovery.

Near-term action is expected to keep bullish bias while holding above the top of rising cloud (currently at 1.2748), though technical picture on daily chart is mixed, as north-heading 14-d momentum is still in negative territory, RSI hit neutrality zone and moving averages are mixed that keep the downside vulnerable on existing risk of recovery stall.

Expect strong bullish signal on break of 1.2817 Fibo barrier that would open way for stronger recovery and expose targets at 1.2879 and 1.2941 (Fibo 50% and 61.8% respectively).

Conversely, failure to register close above broken Fibo 23.6% barrier at 1.2740 would weaken near-term structure, but return and close below daily cloud base (1.2654) will be needed to confirm bearish signal for retest of 1.2620/1.2616 double-bottom and risk of deeper fall on break here.

Res: 1.2766; 1.2817; 1.2879; 1.2941

Sup: 1.2740; 1.2686; 1.2654; 1.2616