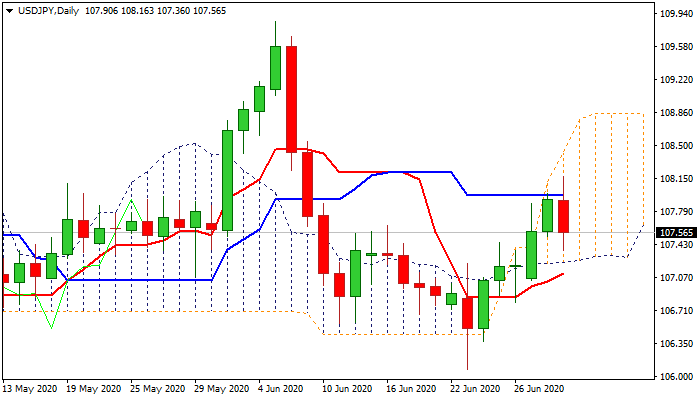

Strong bearish acceleration after bulls got trapped is generating negative signal

The pair fell sharply on Wednesday after attempts to extend five-day rally were strongly rejected and bulls got trapped above daily Kijun-sen / 50% retracement of 109.85/106.07 fall (107.96).

Fresh weakness is also forming bearish engulfing which could add to negative signal if the pattern will be completed today.

The dollar fell after US ADP jobs data missed forecast but huge upward revision of previous month’s figure boosted risk sentiment.

Daily techs support negative scenario as momentum turned sideways, RSI points lower and stochastic is about to reverse from overbought territory.

Fresh bears need daily close below 107.36 (Fibo 38.2% of 106.07/108.16 upleg) and 107.25 (daily cloud base) to signal reversal and open way for further weakness.

Caution on failure to complete bearish engulfing pattern that would signal consolidation and keep alive hopes for renewed attempts higher

Res: 107.96; 108.16; 108.40; 108.54

Sup: 107.51; 107.36;107.25; 107.00