Strong bullish acceleration on positive data/weaker greenback generates initial bullish signal

The Australian dollar advanced over 1% in Asian trading on Thursday and eventually broke above multi-day congestion.

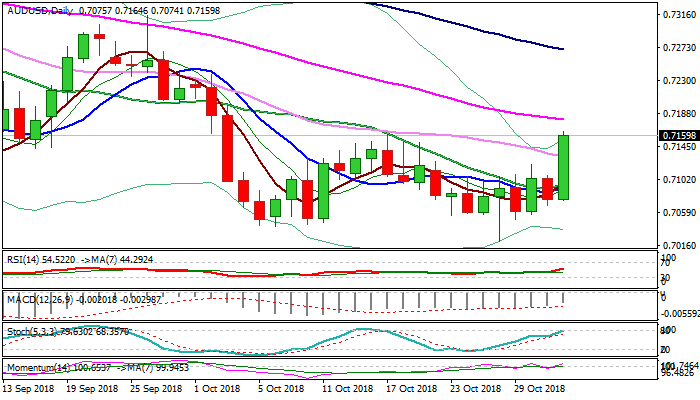

Fresh rally pressures key near-term static support at 0.7159 (17 Oct high) and eyes another pivot at 0.7180 (55SMA), break of which would signal reversal.

The Aussie was inflated by weaker US dollar and received strong boost from widening Australian trade surplus in Sep, as well as stronger than expected China’s Caixin Manufacturing PMI.

Fresh bullish momentum on daily chart supports the advance, with broken 30SMA offering initial support at 0.7131 and strong supply at 0.71 zone (converged 5;10; 20SMA’s).

Res: 0.7180; 0.7202; 0.7245; 0.7271

Sup: 0.7131; 0.7100; 0.7074; 0.7050