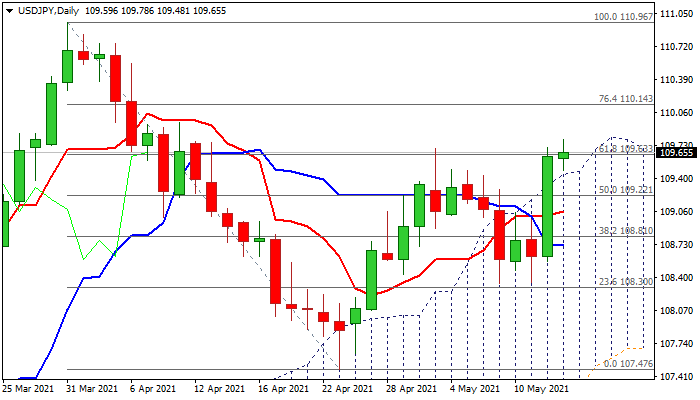

Strong bullish bias above thick daily cloud

The dollar maintains firm tone vs yen on Thursday and consolidating above the top of thick daily cloud after 0.93% advance on Wednesday (the biggest one-day rally in 2021).

Strong bullish acceleration after upbeat US CPI data signaled rising inflationary pressure, made the dollar more attractive for investors.

Wednesday’s rally generated strong bullish signal on break and close above daily cloud and cracking pivotal Fibo barrier at 109.63 (61.8% of 110.96/107.47).

Rising thick daily cloud underpins the near-term action which eyes psychological 110.00 barrier, with daily close above 109.63 (Fibo 61.8%) to confirm bullish stance.

Rising bullish momentum on daily chart and moving averages in positive setup support the notion.

Broken cloud top (109.43) marks strong support which needs to hold and keep fresh bulls in play.

Res: 109.78; 110.00; 110.14; 110.55

Sup: 109.43; 109.22; 108.86; 108.72