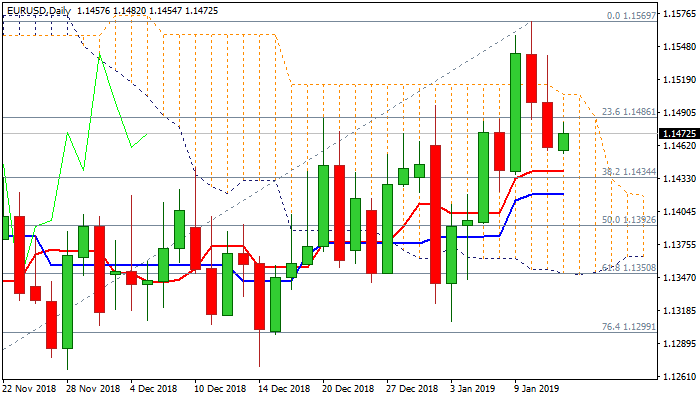

Strong support at 1.1444 under pressure after strong upside rejection and subsequent pullback

The Euro edges higher in early trading on Monday, but near-term outlook remains negative following strong losses in past two days that left bearish candles with long upper shadows.

Also, failure to clearly break above daily cloud (top of cloud will fall significantly this week) adds to weaker tone.

Monday’s action was so far capped by 100SMA (1.1476), which now acts as resistance, following Friday’s break and close below, but is underpinned by strong support at 1.1444 (broken 38.2% of 1.1815/1.1215 fall, reinforced by 10SMA).

Hopes of fresh upside would remain in play while the latter holds, with the notion supported by strengthening momentum on daily chart.

Break above 100SMA and daily cloud top (1.1506) is needed to confirm scenario and shift near-term focus higher.

On the other side, near-term structure would weaken further on sustained break below 10SMA, that would open strong supports provided by a cluster of daily MA’s (20/30/55) at 1.1414/1.1379 zone) and unmask key supports at 1.1350 (daily cloud base / Fibo 61.8% of 1.1215/1.1569 bull-leg).

Res: 1.1476; 1.1506; 1.1540; 1.1569

Sup: 1.1444; 1.1414; 1.1379; 1.1350