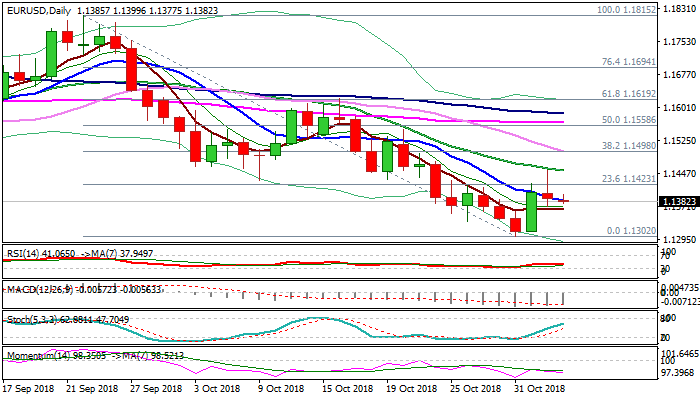

Strong upside rejection on Friday risks reversal

The Euro trades within narrow range in early Monday, capped by the base of thick 4-hr cloud, with near-term risk being shifted lower after strong upside rejection (recovery was capped by falling 20SMA), which left bearish daily candle with long upper shadow on Friday.

Bearishly aligned daily techs (bearish momentum / daily MA’s in negative setup), keep the downside vulnerable, with today’s repeated negative close to complete bull-trap pattern on daily chart and confirm recovery stall, which would risk retest of key 1.1300 support zone (weekly 200SMA / double downside rejection).

Only close above 20SMA (1.1454) would provide relief and signal further recovery.

Res: 1.1400; 1.1423; 1.1454; 1.1499

Sup: 1.1366; 1.1335; 1.1312; 1.1300