Strong US jobs data would further boost Euro bears

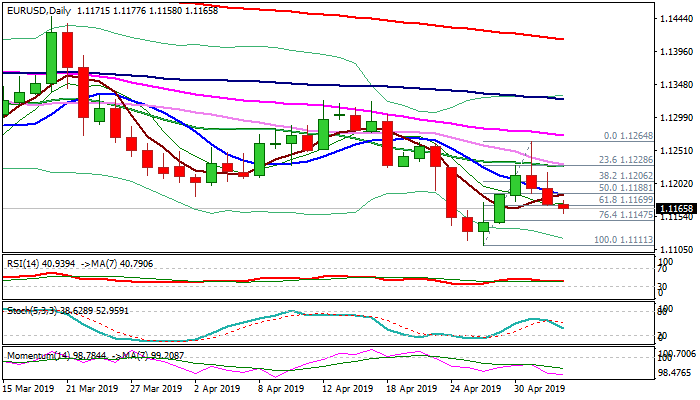

The Euro holds in red for the third straight day and extends weakness through strong Fibo support at 1.1170 (Fibo 61.8% of 1.1111/1.1264 upleg) in early European trading on Friday.

Wednesday’s bearish candle with long upper shadow that was left after Fed, continues to weigh, adding to bearish daily studies.

Bears probe below the base of thick 4-hr cloud (1.1164) and eye Fibo support at 1.1147 (76.4%) which marks the last obstacle on the way towards key support at 1.1111 (2019 low).

EU inflation data (Apr 1.6% f/c vs 1.4% Mar) is in focus in European session, with full calendar in the US session promising a lot of action.

US jobs report is key event today, with general expectations in the market for better than expected results that keep the dollar underpinned ahead of data release.

US unemployment is expected to remain unchanged at 3.8% and Non-Farm payrolls are forecasted for 179K new jobs in Apr vs 182K previous month, with markets seeing chances of even stronger numbers.

Wages will be in focus (Apr 3.4% f/c vs 3.3% Mar) as strong reading in Apr would additionally boost the dollar, but any release below 3.3% would have negative impact.

Res: 1.1177; 1.1184; 1.1219; 1.1228

Sup: 1.1158; 1.1147; 1.1111; 1.1075