The dollar rallies to nine-month high on fresh risk appetite

The pair rallied to new nine-month highs on Wednesday, as renewed risk appetite on signs of falling new virus infections and fading fears about the depth of negative impact on global growth inflated the greenback.

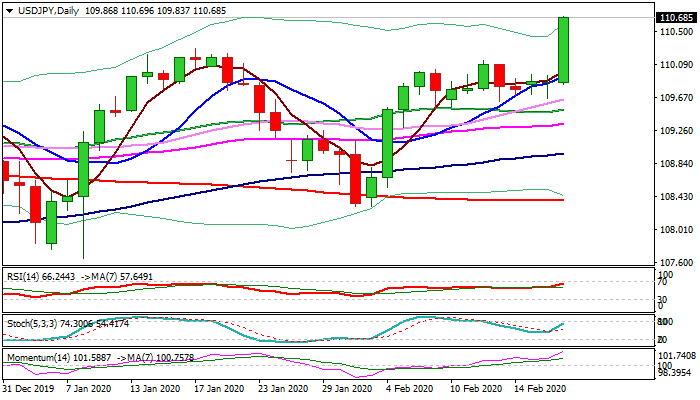

Bulls regained control after two weeks of directionless mode, with three consecutive Dojis in past three days, highlighting strong indecision but also signaled fresh action.

Fresh advance broke above important Fibo barrier at 110.52 (76.4% of Apr/Aug 2019 112.40/104.44 fall) and cracked nearby resistance at 110.67 (21 May high).

Today’s close above broken former high at 110.29 (17 Jan) would generate signal for continuation of larger uptrend from 104.44 (2019 low, posted on 26 Aug).

Upbeat US housing data (Jan building permits 9.2% vs -0.1% f/c and -3.7 prev / Jan housing starts -3.6% vs -30.7% f/c) are expected to add to fresh dollar’s strength as firmly bullish daily studies underpin the action.

Fed minutes are now in focus (due later today) and the greenback might be inflated further if US policymakers show intention to stick to the current policy.

Broken former high (110.29) and psychological 110 level turned to solid supports.

Res: 110.67; 111.00; 111.69; 112.00

Sup: 110.52; 110.29; 110.00; 109.83