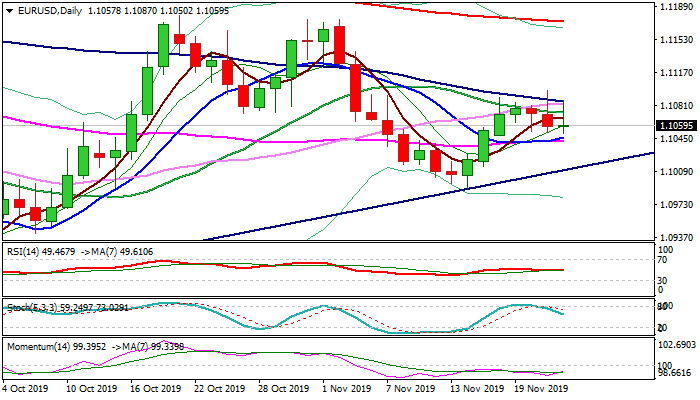

The downside remains at risk as long as daily Kijun-sen caps

The Euro advanced in early European trading on Friday, boosted by better than expected German data (GDP Q3 y/y 1.0% vs 0.5% f/c; Nov Manufacturing PMI 43.8 vs 42.9 f/c), but lower than expected services PMI (Nov 51.3 vs 52.0 f/c) limited gains.

Solid data signal that Germany is on track to avoid recession in the third quarter, despite being slowed down by internal factors, as well as Brexit and US/China trade war.

Thursday’s dip (after probe above daily Kijun-sen (1.1084) stalled on approach to 1.11 barrier) was contained by important Fibo support at 1.1055 (38.2% of 1.0989/1.1096, which also holds Friday’s action), keeping hopes of fresh attempts higher in play.

Daily studies are still mixed but positive signals come from rising momentum and rising 10DMA which diverges from 55DMA, after being converged in past few sessions.

Bulls need close above Kijun-sen to generate bullish signal which will be confirmed on extension and close above 1.1104 (Fibo 61.8% of 1.1175/1.0989).

Otherwise, expect the downside to remain vulnerable, with clear break of 1.1055 Fibo support to generate negative signal, which will be validated on close below 55DMA (1.1042).

Res: 1.1073; 1.1084; 1.1104; 1.1131

Sup: 1.1042; 1.1030; 1.1014; 1.0989