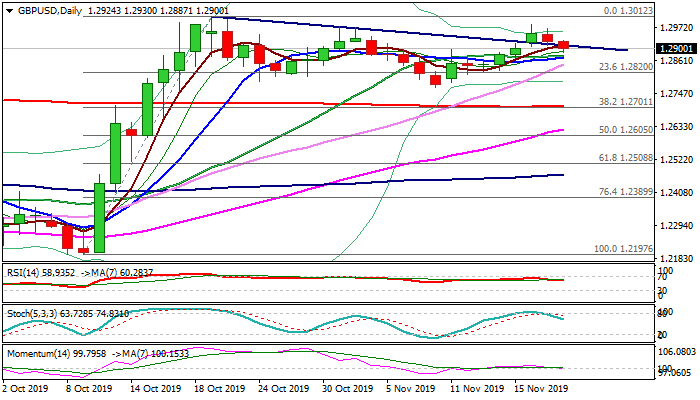

Risk of deeper pullback on violation of converged 20/10DMA’s

Cable dipped to the lowest level this week on extension of pullback after repeated attack at pivotal 1.30 resistance zone stalled.

Return below thin weekly cloud after brief probe above would generate negative signal on Friday’s close below as the action of past five weeks was repeatedly capped by weekly cloud.

The pair is holding in red for the second straight day and eyeing pivotal supports at 1.2869/73 (converged 20/10DMA’s) loss of which would spark further weakness towards 1.2821 (Fibo 23.6% of 1.2197/1.3012 / daily higher base) which guards more significant support at 1.2768 (8 Nov low).

Daily momentum broke into negative territory and stochastic is heading south after reversal from overbought zone, adding to negative near-term outlook.

Reversal above 20/10DMA’s would keep alive bullish bias and hopes for fresh attempt towards 1.30 zone, while close below would weaken near-term structure and risk reversal signal on firm break below 1.2768 pivot.

Res: 1.2934; 1.2969; 1.2984; 1.3012

Sup: 1.2869; 1.2846; 1.2821; 1.2768