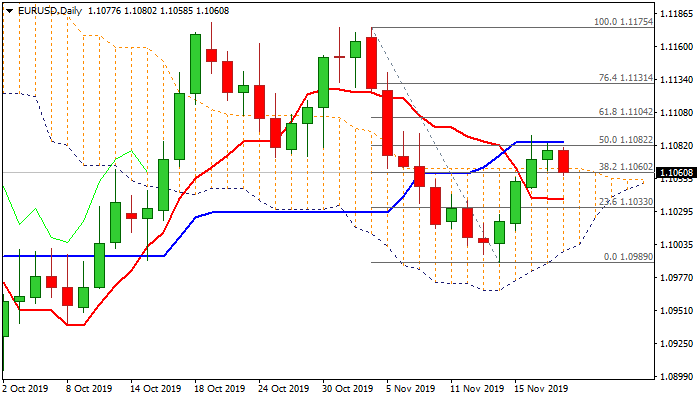

Euro eases on risk off mode and after double failure at daily Kijun-sen

The Euro eases in early Wednesday’s trading and dips back into daily cloud (top of the cloud lays at 1.1064) on fresh risk off mode as US/China trade tensions intensify again.

Bulls enter corrective phase after four-day rally repeatedly closed above daily cloud and generated positive signal but gains were repeatedly capped by daily Kijun-sen (1.1084).

Fresh weakness was signaled by rising bearish momentum and stochastic reversing from overbought territory.

Dips face supports at 1.1051/39 (Fibo 38.2% of 1.0989/1.1089 / converged 55/10 DMA’s) which are expected to contain and keep bulls in play for fresh attempts higher.

Break and close above daily Kijun-sen is needed to signal continuation of recovery leg from 1.0989 (14 Nov low) towards next pivotal barrier at 1.1104 (Fibo 61.8% of 1.1175/1.0989).

Conversely, near-term structure would weaken and focus turn to the downside on break and close below 1.1039 pivot (converged 55/10DMA’s).

The minutes of last FOMC policy meeting is key event today and may provide stronger direction signal.

Res: 1.1065; 1.1084; 1.1104; 1.1131

Sup: 1.1051; 1.1039; 1.1027; 1.1012