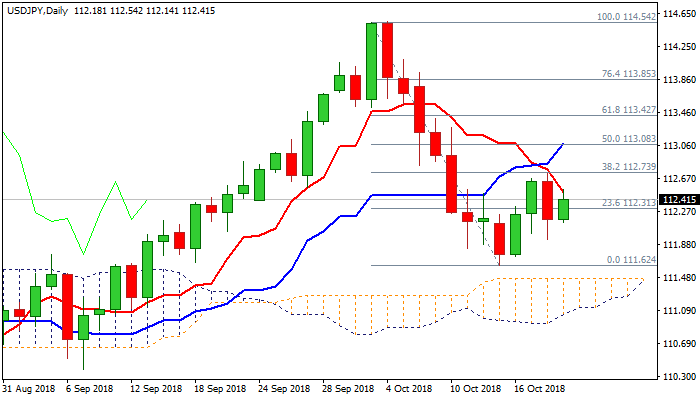

The downside would remain vulnerable while 112.74 pivot caps

The pair regained traction and bounced to 112.50 zone on Friday after bulls were repeatedly capped by pivotal Fibo barrier at 112.74 (38.2% of 114.54/111.62) on Wed/Thu, which resulted is bearish acceleration on Thursday.

Fresh upside attempts emerged from 112 support zone but struggle to break above falling 10SMA / base of thick 4-hr cloud (112.40).

Strong bearish momentum on daily chart warn that bulls may run out of steam again.

Extended congestion could be expected while Fibo barrier at 112.74 caps, which would also keep the downside vulnerable.

Loss of 112.00 handle would risk test of key supports at 111.62 (15 Oct low) and 111.47 (daily cloud top).

Narrowing daily cloud twists next week and could be magnetic.

Alternatively, weekly close above 112.74 pivot would be bullish signal for extension of recovery from 111.62.

Res: 112.54; 112.74; 113.08; 113.42

Sup: 112.14; 112.00; 111.62; 111.47