The Euro enters corrective phase after six-day fall

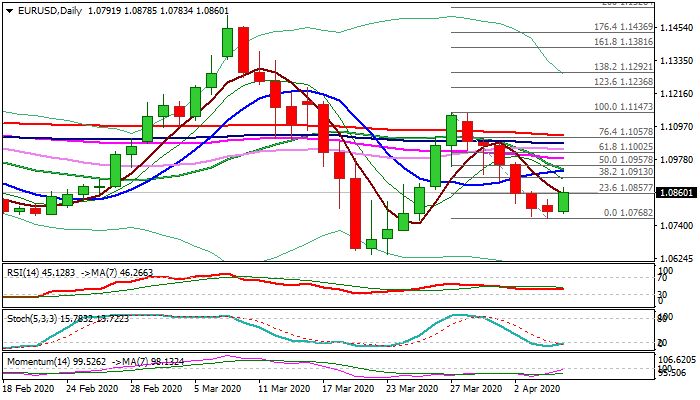

The Euro moved higher in early Tuesday’s trading, inflated from weaker dollar, bouncing from new two-week low at 1.0768, posted after six-day fall.

The action is supported by rising momentum (approaching the borderline of positive territory) and stochastic about to emerge from oversold zone, but so far looks like correction as bears generated strong signal on repeated close below key Fibo level at 1.0831 (61.8% of 1.0635/1.1147).

Fresh bulls have enough space to extend towards key obstacles at 1.0913 (Fibo 38.2% of 1.1147/1.0768 and 1.0939/44 (converging 10/20DMA’s) which should ideally cap and maintain bearish bias.

Caution on daily close above that would sideline bears for stronger correction.

Res: 1.0878; 1.0913; 1.0944; 1.0957

Sup: 1.0831; 1.0800; 1.0783; 1.0768