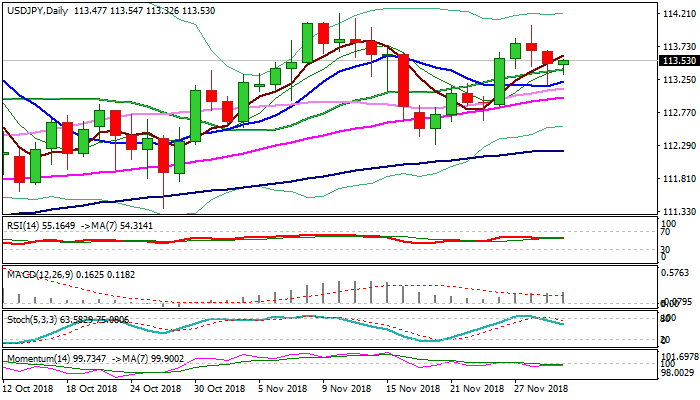

Thursday’s hammer suggest pullback might be over; G20 summit would provide stronger direction signal

Firmer tone on Friday increases hopes of recovery as Thursday’s strong downside rejection left hammer candle, signaling that two-day pullback might be over.

Dip was contained by 10SMA (113.15) and subsequent bounce resulted in daily close above 20SMA (113.38) on Thursday, keeping MA’s in bullish configuration.

Recovery was so far limited due to flat momentum studies and looking for a catalyst to spark fresh acceleration towards key barriers at 114.03 (28 Nov high) and 114.20 (12 Nov high).

All eyes are on G20 summit, with focus on Trump / Xi meeting over tariffs conflict.

Initial optimism that two presidents would reach the deal and prevent trade war faded on President Trump’s most recent messages, where he signaled tariff hike.

But any positive hint of the meeting outcome could spark fresh rally in riskier assets, which would put safe-haven yen under renewed pressure.

On the other side, no-deal and stronger signals of trade conflict escalation would significantly increase appetite for safe-haven assets and boost yen.

Res: 113.60; 114.03; 114.20; 114.54

Sup: 113.39; 113.18; 112.99; 112.66