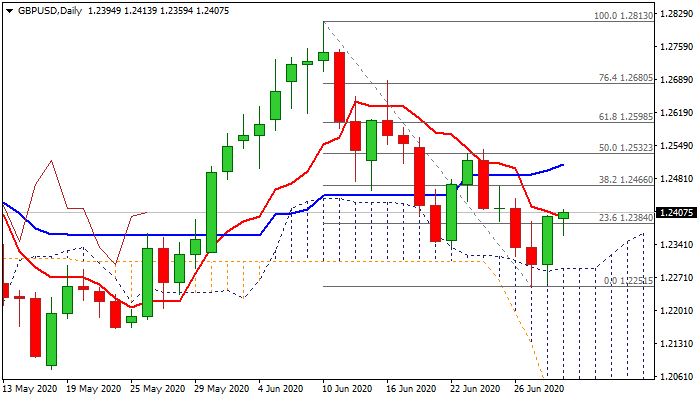

Tuesday’s bullish engulfing signals reversal but more work at the upside required for confirmation

Cable stands at the front foot on Wednesday, following strong rebound after repeated failure to clearly penetrate daily cloud (top of thick cloud lays at 1.2288).

The pair advanced 0.83% on Tuesday and formed bullish outside day pattern that marks initial reversal signal.

Daily cloud ascends and underpins recovery, along with solid UK manufacturing data, but fresh advance needs to clear 1.2402/13 barriers (10/55DMA’s) to sideline existing downside risk, while extension above 1.2466 (Fibo 38.2% of 1.2813/1.2251 / 100DMA) is needed to confirm reversal.

Daily studies are improving but momentum is still in the negative territory, with today’s close below 10DMA to keep the downside vulnerable.

US jobs and manufacturing data, due later today, would provide fresh direction signals.

Res: 1.2413; 1.2466; 1.2517; 1.2532

Sup: 1.2384; 1.2359; 1.2335; 1.2300