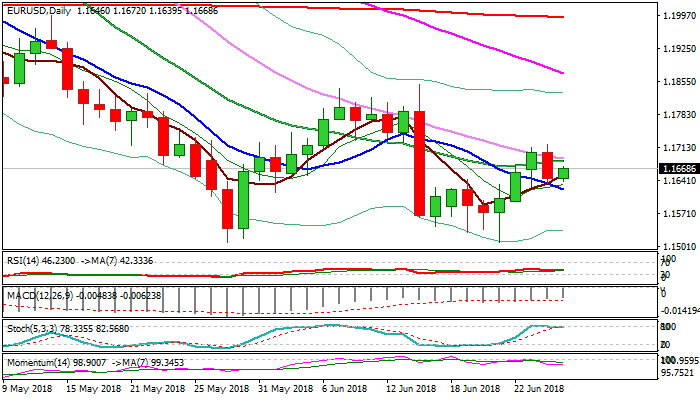

Tuesday’s fall dents bullish bias but break below 10SMA needed to confirm reversal

The Euro is slightly higher in early Wednesday’s trading, following Tuesday’s pullback after three-day recovery rally stalled at key Fibo barrier at 1.1718.

Dips was so far contained above 10SMA (1.1623) which marks lower pivot but Tuesday’s bearish Outside Day was seen as negative signal.

The downside became more vulnerable after Tuesday’s weakness, as momentum is negative and slow stochastic reverses from overbought zone and forming bear-cross with its 7-d MA.

Bears need close below 10SMA for confirmation of reversal and extension towards next strong supports at 1.1589 (Fibo 61.8% of 1.1508/1.1720 upleg) and 1.1570 (base of thick 4-hr cloud).

At the upside, broken 20SMA (1.1683) marks initial barrier which needs to cap and keep near-term risk shifted lower.

Close above 20SMA would ease downside pressure and re-expose key barrier at 1.1718 (Fibo 61.8% of 1.1848/1.1508 bear-leg), break of which would signal continuation of recovery from 1.1508 (21 Jun low).

Res: 1.1683; 1.1720; 1.1746; 1.1767

Sup: 1.1639; 1.1623; 1.1589; 1.1570